Logan Paul-led startup using blockchain to facilitate fractional ownership of physical assets.

Blockchain platforms that enable users to buy and sell virtual collectibles have exploded in popularity in recent years, benefitting companies like Vancouver’s Dapper Labs, which has seen exponential growth fuelled by rising demand for non-fungible tokens (NFTs).

While Dapper is partnering with sports leagues across the world to create digital collectibles, other companies are looking to leverage the same underlying tech to offer fractional equity stakes in actual sports trading cards and other rare physical assets.

“[Bringing] that democratized feel to an already established physical asset class that people understand … makes perfect sense.”

-Ryan Bahadori, Liquid MarketPlace

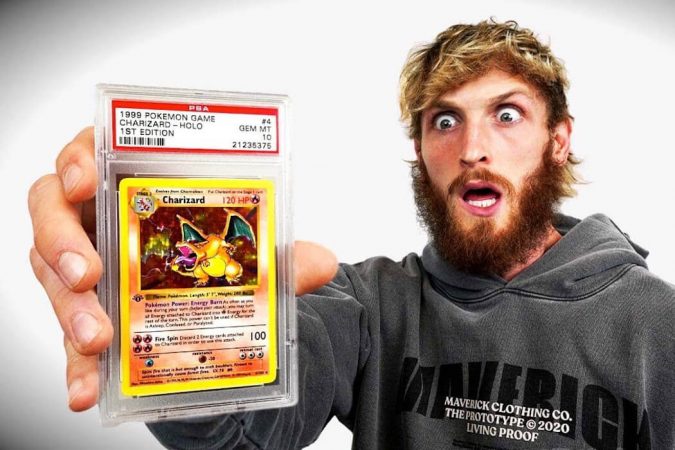

Co-founded by a group of collectors that includes CEO Ryan Bahadori, president and chairman Amin Nikdel, and social media influencer Logan Paul—who has joined the company as chief strategy officer—Toronto-based Liquid MarketPlace wants the general public to be able to own a piece of a LeBron James rookie card or perhaps their favorite rare Pokémon.

With the launch of its marketplace, Liquid MarketPlace joins a growing group of companies looking to use blockchain tech to “tokenize” physical collectibles.

Bahadori, a “longtime collector” and crypto investor who owns a collection of Pokémon, hockey, and basketball cards valued “around the mid six-figure range,” said the idea for Liquid MarketPlace came following a discussion he had with Nikdel, a friend and serial tech entrepreneur.

“I said, ‘Hey, why don’t we create a platform that would give people an equal opportunity and really level the playing field and allow them to put whatever amount of money they want into these traditionally unobtainable assets,’” Bahadori said in an interview with BetaKit.

Bahadori and Nikdel teamed up with Paul to found Liquid MarketPlace in early 2021 to bring items typically accessible only to ultra-wealthy individuals to other users. The company’s platform, which operates on the Ethereum blockchain, turns physical collectibles like Pokémon and sports cards into tokens that can be bought, sold, and traded through its marketplace. The company takes an eight percent fee when items are first tokenized and then sold through its platform, and then collects a two percent fee from stakes re-sold on the secondary marketplace it provides.

RELATED: Our Lady Peace’s Raine Maida says creators can’t afford “not to take advantage of Web3, NFTs

“There’s a real big worldwide understanding of the importance of physical collectibles,” said Bahadori. “By tokenizing physical items, we are able to transform the collecting process, offering even the smallest collector ownership opportunities.”

The launch of the startup’s marketplace comes as the sports card industry is booming. Amid this environment, the sector has increasingly turned towards tech to support its growth—a transition that a combination of new entrants like Liquid MarketPlace and long-established players like Collectors have sought to support.

On the virtual side, Dapper Labs has become a leader in the NFT space, fuelled in part by the success of its NBA Top Shot virtual basketball trading card platform.

“[Bringing] that democratized feel to an already established physical asset class that people understand, I think, just makes perfect sense,” said Bahadori. “These NFTs, a lot of people don’t understand … a lot of people don’t understand that utility, don’t understand the benefit. But with Liquid MarketPlace, it’s quite simple: these physical tokens give you direct co-ownership interest in that physical asset.”

RELATED: Vancouver-based Dapper Labs raises $250 million USD, partners with Spain’s LaLiga

In its quest to tokenize physical collectibles and enable fractional ownership of them, Liquid MarketPlace’s competitors include Los Angeles-based Dibbs and New York’s Rally—which secured $15 million USD last fall at a $175 million valuation from a list of backers that includes Jimmy Kimmel and Kevin Durant’s venture fund, Thirty Five Ventures.

Bahadori claims that one of the things that differentiates Liquid MarketPlace from some of its competitors is its “democratic approach” to handling tokens purchased through its marketplace, which enables users to decide when to sell their stakes and for how much.

“Users on our competitor’s platforms, they don’t really get to make decisions on when it sells and what value itself,” said Bahadori. “They have just come along for the ride, so to speak, and our competitors make all the decisions for them.”

Notably, United States courts are currently deciding whether NFTs represent legally-binding ownership stakes and constitute securities. The latter is a significant point because securities mean regulation.

Liquid MarketPlace is part of a growing group looking to use blockchain tech to “tokenize” physical collectibles.

Liquid MarketPlace is part of a growing group looking to use blockchain tech to “tokenize” physical collectibles.

Bahadori argues that Liquid MarketPlace doesn’t deal in securities. Unlike some of its competitors—who Bahadori says buy assets, place them in shell companies, and then sell shares in said companies to investors—Liquid MarketPlace does not directly buy or sell any of the assets sold on its platform.

“We have legal teams in the United States and legal teams in Canada that are of a very strong opinion that we are not selling securities, because collectibles are not securities,” said Bahadori.

To date, Bahadori says Liquid MarketPlace has raised about $10 million CAD from a list of backers that includes Canaccord Genuity and Complex founder Rich Antoniello.

Liquid MarketPlace claims all physical items listed for sale on its platform are inspected for authenticity, photographed, and insured, before being stored in a “bank-grade” vault that is owned and managed by a third-party.

RELATED: Fractional real estate investing startup Willow comes out of stealth

The startup’s initial drop will be focused on high-value trading cards, including an autographed LeBron James jersey patch rookie card and a million-dollar Pikachu card.

Over the next two to three months, the company plans to introduce new categories as it expands its user base. Bahadori added that “at some point in the future,” Liquid MarketPlace will expand into real estate.

Canada’s fractional real estate investing space currently features a list of players that includes Willow, BuyProperly, and Key.

Feature image from Logan Paul via YouTube.

.