Québec’s later-stage tech startups make waves while early-stage funding loses steam.

Québec’s tech sector set a new record for venture funding in the first quarter of 2021 thanks to a surge in late-stage deals, according to a new report from briefed.in.

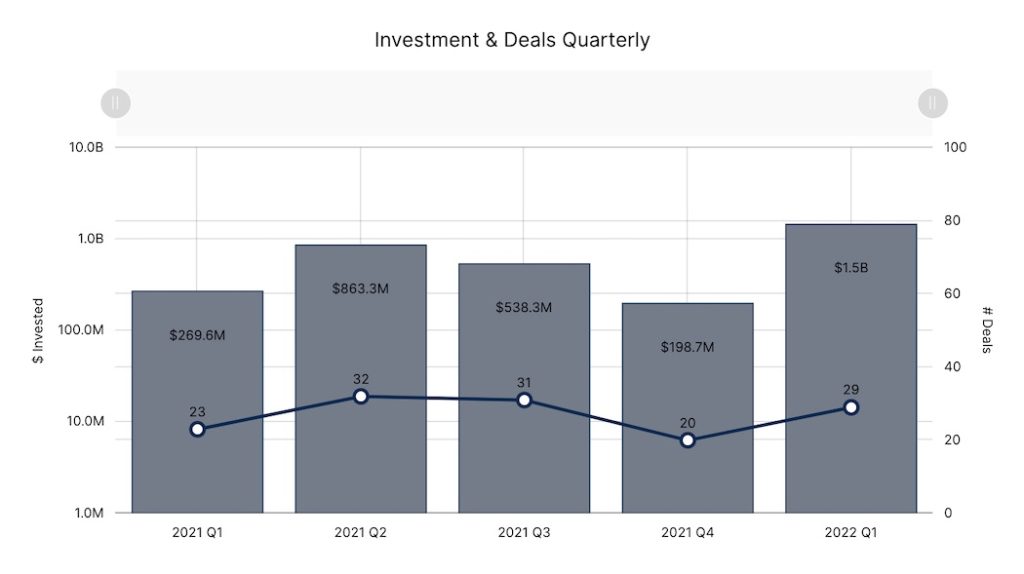

In Q1 2022, Québec-based startups raised a total of $1.46 billion, an increase of 633 percent from the previous quarter and 440 percent year-over-year. In the first quarter of 2022 alone, Québec startups raised 77 percent of all funding raised in the previous year.

Not only did the first quarter break records in Quebec; it also saw an increase in activity. Twenty-nine deals closed in the province during Q1 2022, which represents a 45 percent quarter-over-quarter increase, and a 26 percent year-over-year increase.

“We saw major deals in Québec in Q1 of 2022, which demonstrate that we have the capacity to support strong, innovative startups.”

“We saw major deals in Québec in Q1 of 2022, which demonstrate that we have the capacity to support strong, innovative startups,” said Olivier Quenneville, vice president of business intelligence and development at Réseau Capital. “Support from the government through key public policies and investments with the leverage provided by a strong private capital ecosystem is also playing an important role to drive those investments.”

Two other Québec-based stakeholders that spoke with BetaKit noted that public investment is playing a significant role in the province’s venture funding performance. Québec’s National Assembly has created several agencies that are now key financiers for the province’s tech startups, big and small. Two of these agencies, Fonds de solidarité FTQ and Investissement Québec, were among the active investors in the province during Q1 2022.

“Public investment and support from government funds, for example, Investissement Québec, means there is greater acknowledgement of our startups by these institutional investors,” said Liette Lamonde, managing director of Startup Montréal.

In the first quarter of 2022 alone, Quebec startups raised 77 percent of all funding raised in 2021. (Source: briefed.in)

In the first quarter of 2022 alone, Quebec startups raised 77 percent of all funding raised in 2021. (Source: briefed.in)

Québec’s seeds are now bearing fruit

Late-stage activity in Q1 2022 vastly surpassed that of the previous quarter, accounting for 65 percent of all capital and 16 percent of all deals closed in Québec. Among Québec’s largest venture rounds from the first quarter were Paper’s $343 million Series D funding round, RenoRun’s $181 million Series B funding round, and Ventus Therapeutics’ $178 million Series C funding round.

Both Paper and RenoRun are portfolio companies of Real Ventures, which is one of the most active early-stage investors in Québec. According to Sam Haffar, partner at Real Ventures, the venture firm has deployed $140 million in pre-seed and seed capital to date. Haffar said it’s “rewarding” to see Real’s investments contribute to Québec’s record quarter.

“The growing recognition of the potential for Québec-based tech companies has significantly and positively impacted the scale of capital raised in Q1 2022,” Haffar said. “Underpinning Québec’s record quarter is the maturation of pre-seed and seed investments made five to seven years ago.”

More momentum needed for early-stage funding

Of the 29 deals that closed in Québec during Q1 2022, roughly 30 percent were seed-stage deals. Some of the largest seed-stage deals from the quarter included Nord Quantique’s $9.5 million financing round, Prehos’ $7.2 million funding round, and Clinia’s $4.3 million seed funding round.

While Québec may appear to have a healthy distribution of deals at first glance, the province’s early-stage funding activity dipped slightly in Q1 2022 compared to Q4 2021, which saw nine seed-stage deals and two pre-seed deals. briefed.in tracked no pre-seed deals during Q1 2022 and nine seed-stage deals.

This stagnant early-stage activity is certainly not unique to Québec. This trend was observed across many other Canadian ecosystems in the first quarter of the year. In Toronto, British Columbia, and Alberta, briefed.in either tracked— or local stakeholders independently identified —a marked decline in pre-seed and seed-stage deals during Q1 2022.

Of the 29 deals that closed in Quebec during Q1 2022, roughly 30 percent were seed-stage deals. (Source: briefed.in)

Of the 29 deals that closed in Quebec during Q1 2022, roughly 30 percent were seed-stage deals. (Source: briefed.in)

Quenneville noted Québec’s government has made significant efforts to promote access to early-stage capital in the province over the last few years. This point was echoed by Sébastien Tanguay, managing director of Québec City-based accelerator Le CAMP, who said the government, as well as local accelerators, have tried to prioritize filling gaps for early-stage companies.

“While we, as an ecosystem, will always have to promote easy access to capital for our early-stage startups, we also need to make sure that the overall financing chain is healthy and performing accordingly,” added Quenneville.

Will investors tighten purse strings in coming quarters?

While many tech ecosystems across Canada tracked record funding in the first quarter of the year, most stakeholders in those ecosystems are expecting the frenetic pace of venture capital to temper down in the months ahead.

“We anticipate that valuations of Québec-based companies will continue to follow the trends of the broader Canadian and US markets,” Haffar added. “That being said, we have seen more resilience in the valuation[s] of Canadian companies than those in the US.”

Tanguay has observed many limited partners in Québec are waiting to see how the economy will react to certain current events, including the Russian invasion of Ukraine and rising inflation at home, which may slow the province’s venture market over the next 12 months.

“While [Québec’s Q1 2022 performance] is very good news, we do remain cautious about the global business environment, with headwind factors such as inflation, higher interest rates and geopolitical turmoil,” Quenneville added. “We need to keep working hard to maintain the momentum and to promote a healthy innovation ecosystem.”

The full briefed.in report on Québec can be found here.

BetaKit is a briefed.in Tech Report media partner.

.