US-based Monarch “fast-tracked” its Canadian expansion after the Mint shutdown news.

Last month, Intuit announced that it is shutting down Mint. The popular free budgeting app, which Intuit acquired back in 2009 and reportedly had 3.6 million monthly active users in 2021, will no longer be available as of the start of 2024.

Shortly after that news broke, San Francisco-based personal finance app Monarch Money identified a gap in the market and decided to hasten its Canadian expansion plans.

Monarch has already amassed about 3,500 active Canadian users.

In addition to Monarch, a variety of other alternatives to Mint exist, including platforms like NerdWallet, Rocket Money, Quicken Simplifi, and YNAB. But according to Monarch co-founder and CEO Val Agostino, in Canada, the comparable options for consumers are slim.

“There were so many Canadian Mint users,” Monarch co-founder and CEO Val Agostino told BetaKit in an exclusive interview. “In America, there’s a handful of [Mint] competitors and folks are trying different things, but in Canada, there weren’t as many options. We saw on Reddit and elsewhere the Canadian frustration of, ‘Oh my gosh there’s nothing else we can use that really [does] what Mint did,’ so we fast-tracked the Canadian release.”

Monarch is a subscription-based financial planning app that was founded in 2018 by Agostinto—Mint’s first product manager—head of design Jon Sutherland, and Ozzie Osman. The consumer FinTech startup has raised $20 million in venture capital funding to date from a group that includes Accel and SignalFire.

Following the Intuit-Mint wind-down news, Monarch has already seen its user base grow. Agostino sees greater opportunity for the startup with its recent push into Canada.

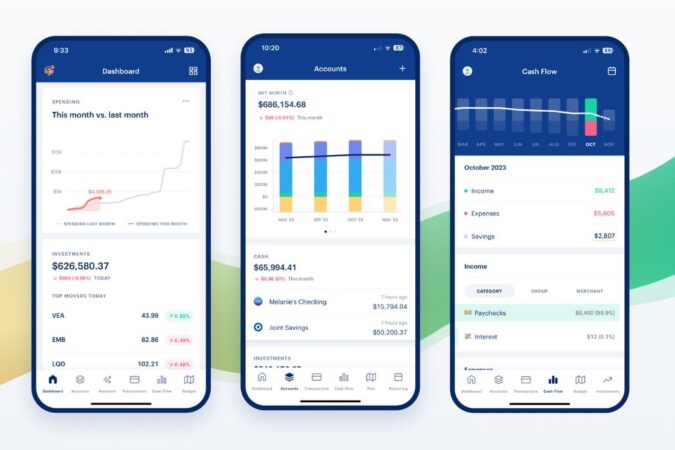

In late November, Monarch opened up its waitlist to Canadians, and last week, the startup quietly rolled out its platform in Canada—marking its first launch outside the United States (US). Since then, Monarch has already amassed about 3,500 active Canadian users. Today, Canadian users have full access to Monarch’s budgeting, investment tracking, and savings features, including through a 30-day free trial.

RELATED: Banking apps Pillar and Billi shut down as funding dries up for FinTech businesses

But Monarch in its current form also has some limitations for Canadian users: it can only support billing via credit card and USD, its bank connectivity remains limited, and the app does not support multiple currencies. The company is working to add CAD billing and improve its bank connectivity over the coming months.

Agostino noted that there are still some institutions that Monarch is not connected to yet, adding that “if you’re one of our early Canadian users, I would say, just recognize that we’ve fast-tracked this and we’re going to continue investing in the data side here.”

In the near term, Monarch may face some challenges on this front north of the border given Canada’s much-delayed implementation of open banking to expedite connectivity.

For its part, Intuit has been pushing Mint users to switch over to Credit Karma, a similar, much larger service that it purchased in 2020. While Credit Karma has nearly 130 million registered users, unlike Mint and Monarch, it does not offer budgeting features.

RELATED: Conquest Planning raises $24 million to expand AI financial advisor solution to US, UK markets

Disillusioned with Mint’s direction, Agostino and the original Mint team left the company within six months of the Intuit acquisition. In a recent Monarch blog post, Agostino called the Mint wind-down news “bittersweet,” but noted that “a free personal finance app is simply not a viable business.”

According to Agostino, Mint’s business model was to present users with offers for various financial products, including banking offerings and credit cards, and earn a referral fee if users applied for one of those products. However, he wrote that this model was never able to cover Mint’s data costs of delivering this service, and its ad-based business model created misaligned incentives between the company and its users.

“I always felt like this is the obvious next step in the personal finance space, to go beyond budgeting.”

Val Agostino, Monarch Money

With the Intuit deal, the thinking was that Intuit could offset Mint’s losses by using it to funnel more users into TurboTax, wrote Agostino, but Credit Karma provides a much larger platform for cross-selling other Intuit products like TurboTax. “If you’re Intuit, it doesn’t make sense to keep investing in both of these consumer platforms, so I’m not surprised they’re shutting Mint down and consolidating on Credit Karma,” he added.

With its subscription-based app, Monarch hopes to avoid the same issues. Agostino pitched Monarch as a worthy alternative to Mint, noting that Monarch offers many of the same budget-tracking features, permits users to import Mint data and preserve their history from the soon-to-be shuttered app, and offers more than just budgeting with financial planning features.

The Monarch CEO noted that the financial planning industry typically caters to clients who generate $5,000 or more in annual fees, which he said prices out the majority of the market.

“I always felt like this is the obvious next step in the personal finance space, to go beyond budgeting and to help households with that use case of planning and advice,” said Agostino.

With files from Isabelle Kirkwood.

Feature image courtesy Monarch Money.

.