After launching tools for cross-border payments, Finofo aims to become “all-in-one” solution for finance teams.

With the hope of streamlining workflows, businesses are rapidly accelerating their adoption of software and other digital tools.

However, adoption of multiple separate applications can also do the opposite, and cause disruptions in team productivity.

For businesses’ finance teams, for example, one platform may be used for banking and payment needs, and Excel or another SaaS application may be used for financial planning and analysis.Perhaps a third app is needed for foreign-exchange trading.

Finofo will be allocating this capital to hire four people this year, including two engineers and up to two salespeople.

Calgary-based Finofo is developing a platform meant to be the “all-in-one” solution for businesses’ financial needs, starting with tools for global cross-border payments.

In what it called “Phase 1” of its product development, Finofo said its platform enables businesses to get multi-currency accounts to send and receive money globally, convert money into different currencies, and automate accounts payable.

Along with the public launch of its platform on Tuesday, Finofo has also revealed a $1.6-million CAD ($1.25 million USD) pre-seed round it closed in January, raised entirely on a SAFE note.

Motivate Venture Capital led the financing with participation from SaaS Venture Capital, Desjardins Financial Holding, Sweet Spot Capital, and contributions from friends and family.

In an interview with BetaKit, co-founder and CFO Charles Maranda explained how Motivate became the lead investor in the round through its connection with the venture capital firm Andreessen Horowitz (a16z).

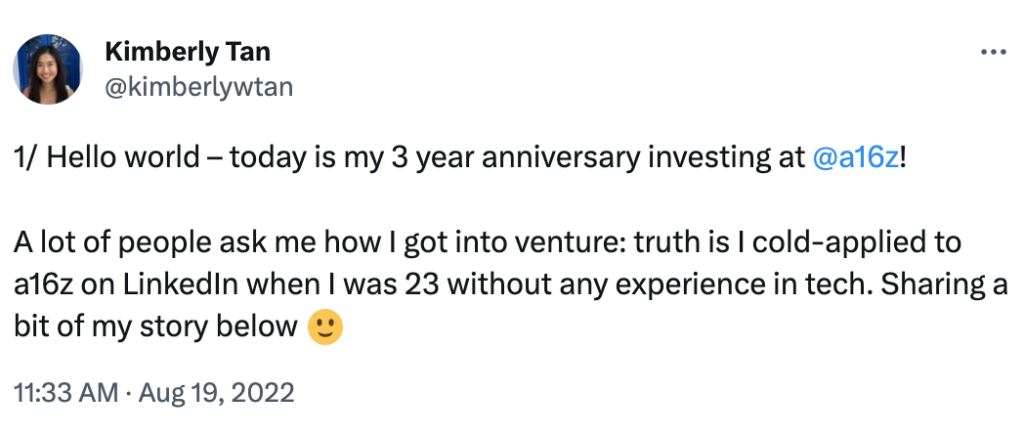

a16z investment partner Kimberly Tan wrote on X (then Twitter) in August 2022, explaining that she secured an opportunity in venture through “cold-applying” or cold-DMing. Taking a page out of her book, Maranda said Finofo CEO Prateek Sodhi reached out to Tan through a cold DM as well, which resulted in a meeting with the firm.

“These guys really liked us but … [a16z] very rarely does pre-seed,” Maranda explained. However: “They referred us to a bunch of their partner funds with a recommendation.” One of those firms was Motivate.

Currently a team of six, Maranda said Finofo will be allocating this capital to hire four people this year. As the startup builds out the next phases of its platform, it plans to add two engineers, led by its CTO and co-founder Malav Shah, and “one or two” salespeople.

RELATED: Kooltra raises $6.5 million to modernize foreign exchange industry

With the launch of the initial stages of its platform, Finofo said it is targeting businesses that trade around $10 to $15 million in currencies annually. In terms of verticals, he said Finofo’s focus is on businesses in manufacturing, transportation, and natural materials.

Maranda gave one hypothetical example of a paint wholesaler that could use Finofo’s platform to make purchases in currencies across different countries like China, Europe, and the United States, as well as sell its products in Canadian dollars.

Following the launch of its suite of cross-border payment tools, Maranda said Finofo’s next phase will focus on developing the beginning of its smart hedge engine, meant to provide streamlined currency hedging trade execution–a strategy that minimizes the price risk of currencies while trading.

Maranda said Finofo also plans to build financial planning and analysis solutions to provide businesses with real-time foreign-exchange risk analytics.

With the goal of hitting these product development milestones, Maranda said Finofo plans to raise another round of funding in the next 12 months.

Featured image courtesy Finofo.

.